Portrait Weekly Framing: DKS & Tech Shifts in Apparel

Examining a "GameChanger" for a traditional brick & mortar retailer

Welcome to this week’s edition of the Portrait Weekly Framing. Today, we’ll be taking a look at how companies in the apparel industry are using technology to revamp their marketing strategies or overall offerings, and diving into DKS’ efforts in particular.

An American staple, Levi’s denim has always felt like an old school classic. However, the company also boasts an impressive data infrastructure, as highlighted by a recent WSJ article. Specifically, Levi’s has made a concerted effort in recent years to consolidate its vast consumer data into one “tent,” discovering deeper insights into consumer behavior. As a result, the company recently captured a shift toward baggier clothing ahead of the market, allowing Levi’s to capitalize by swiftly shifting its production and strategy.

With a subtle shift in technology driving significant business momentum and performance, I grew curious to learn about other apparel companies which could be implementing technological upgrades. To learn more, I turned to Portrait, looking to highlight companies with technological developments or breakthroughs akin to Levi's data transformation.

From the results, I quickly learned how many companies are undergoing transformations to drive operational efficiency, enhance customer experience, and create sustainable competitive advantages through data-driven / AI-powered decision making.

Overall Takeaways

The analysis of companies undergoing digital transformations similar to Levi's reveals several key patterns in successful implementations. Most notably, companies that achieved the strongest results approached transformation holistically - implementing comprehensive changes across technology infrastructure, organizational structure, and operational processes rather than pursuing isolated digital initiatives. The most successful transformations consistently demonstrated measurable improvements across multiple dimensions: revenue growth (typically 15-50% increases), margin expansion (200-400 basis points), and enhanced customer engagement metrics (often doubling or tripling digital engagement rates).

A critical success factor emerging from the analysis is the importance of maintaining operational stability while implementing transformative changes. Companies like DICK'S Sporting Goods and Abercrombie & Fitch demonstrated this balance particularly well, achieving significant digital advancement while maintaining or improving profitability throughout their transformation journeys. Additionally, the most successful transformations were characterized by significant investments in data analytics capabilities, with companies leveraging advanced technologies like AI and machine learning to drive more sophisticated decision-making across merchandising, inventory management, and customer engagement.

One of the companies Portrait highlighted in the full write-up was Dick’s Sporting Goods (DKS). Its new GameChanger platform seems to be growing quite impressively, and at a meaningful scale ($100mm in annual revenue).

GameChanger Overview & Financial Analysis

Platform Overview & Capabilities

GameChanger is DICK'S Sporting Goods' youth sports technology platform that provides comprehensive digital solutions for youth sports participants, families, and coaches. The platform offers live streaming, scheduling, communications, and scorekeeping functionality through a SaaS-based subscription model (DKS 10-Q Q1 2024). Originally focused on baseball and softball, GameChanger has expanded to include basketball, volleyball, and other sports, demonstrating its evolution into a multi-sport platform (DICK'S Sporting Goods, Inc. Presents at Goldman Sachs Conference).

Scale & Performance Metrics

GameChanger has achieved significant scale and demonstrates strong operational metrics:

Current Revenue: Approximately $100 million annual run rate (DICK'S Sporting Goods, Inc. Presents at Barclays Conference)

Growth Rate: 30-40% compound annual growth rate maintained for several years (DICK'S Sporting Goods, Inc., Q3 2025 Earnings Call)

User Base: Over 6 million athletes and families (DICK'S Sporting Goods, Inc. Presents at Goldman Sachs Conference)

Engagement: Users spend approximately 45 minutes per day on the platform (DICK'S Sporting Goods, Inc. Presents at Goldman Sachs Conference)

Platform Usage: Over 1 million teams used the platform in 2023, capturing moments from 7 million games and creating 110 million highlight clips (DICK'S Sporting Goods, Inc., Q4 2024 Earnings Call)

Financial Profile & Market Opportunity

GameChanger operates in a substantial addressable market with strong financial characteristics:

Total Addressable Market: $30-40 billion (DICK'S Sporting Goods, Inc. Presents at Barclays Conference)

Business Model: Highly profitable SaaS subscription model (DICK'S Sporting Goods, Inc., Q3 2025 Earnings Call)

Revenue Growth: 35%+ CAGR since 2017 (DICK'S Sporting Goods, Inc., Q4 2024 Earnings Call)

Strategic Value: Beginning in fiscal 2024, GameChanger revenue is included in comparable sales calculations, indicating its growing importance (DKS 10-Q Q1 2024)

Strategic Value to DICK'S

GameChanger provides significant strategic advantages beyond its direct financial contribution:

Customer Value: GameChanger families who are also DICK'S ScoreCard members spend over 2x more annually compared to typical ScoreCard members (DICK'S Sporting Goods, Inc., Q4 2024 Earnings Call)

Data Advantages: Provides what management believes is the best data set in youth sports (DICK'S Sporting Goods, Inc. Presents at Goldman Sachs Conference)

Engagement: Users average 13 app visits per month, creating multiple touchpoints for customer interaction (DICK'S Sporting Goods, Inc., Q4 2024 Earnings Call)

DICK'S Overall Financial Context

To understand GameChanger within DICK'S broader business:

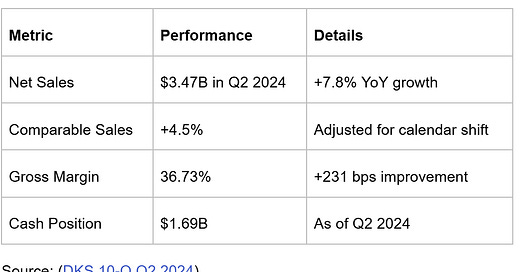

Recent Financial Performance

Future Growth Opportunities

Management has identified several growth vectors for GameChanger:

Advertising revenue through retail media network development (DICK'S Sporting Goods, Inc. Presents at Morgan Stanley Conference)

Enhanced data mining capabilities for personalization (DICK'S Sporting Goods, Inc. Presents at Morgan Stanley Conference)

Expansion into additional sports categories (DICK'S Sporting Goods, Inc., Q3 2025 Earnings Call)

Integration of AI tools for automated game analysis and highlight creation (DICK'S Sporting Goods, Inc. Presents at Goldman Sachs Conference)

This analysis demonstrates GameChanger's strong position within DICK'S portfolio, combining robust financial performance with significant strategic value and future growth potential.

With over 6 million users, high engagement, and virtuous feedback to DICK’s overall business, the GameChanger platform seems to illustrate DICK’s successful management of a product ecosystem and technology. Asking Portrait to dig deeper here, the case study on GameChanger’s development is quite interesting - it’s clearly no overnight success.

GameChanger Platform Evolution: A Case Study (2016-2024)

Initial Acquisition & Integration (2016-2017)

DICK'S Sporting Goods acquired GameChanger Media in 2016 as part of a broader digital strategy investment, paying a combined $63.8 million for GameChanger and Affinity Sports (DKS 10-K FY 2017). The platform was initially integrated into DICK'S Team Sports HQ initiative, focusing primarily on baseball and softball scoring capabilities. During this early period, management positioned GameChanger as a strategic asset for building deeper connections with youth athletes and their families, viewing it as a key component of their digital ecosystem development (DICK'S Sporting Goods, Inc. Presents at Bank of America Merrill Lynch Consumer & Retail Technology Conference, Mar-14-2018 08:50 AM).

Early Platform Evolution (2018-2019)

By 2018-2019, GameChanger began expanding beyond its initial focus on baseball scoring. The platform launched new team management applications that included scheduling, practice coordination, and parent volunteer organization capabilities (Dick's Sporting Goods, Inc. Presents at Goldman Sachs 25th Annual Global Retailing Conference, Sep-05-2018 02:30 PM). A crucial strategic decision came in 2019 when DICK'S chose to retain GameChanger while divesting other technology assets (Blue Sombrero and Affinity Sports) to Stack Sports for $40.4 million, signaling management's view of GameChanger's unique strategic value (DKS 10-Q Q2 2019).

Digital Transformation & COVID Acceleration (2020-2021)

The COVID-19 period marked significant evolution in GameChanger's capabilities and strategic importance. The platform underwent substantial transformation of its user experience, including:

Integration of video streaming capabilities

Addition of highlight features

Expansion into new sports beyond baseball/softball

Development of mobile-first delivery (DICK'S Sporting Goods, Inc., Q4 2023 Earnings Call, Mar 07, 2023)

Scale Achievement (2022-2023)

By 2023, GameChanger had achieved significant scale, demonstrating several key metrics

Source: (DICK'S Sporting Goods, Inc., Q4 2023 Earnings Call, Mar 07, 2023)

The platform's strategic value became increasingly evident as GameChanger users who were also ScoreCard members spent twice as much as typical ScoreCard customers (DICK'S Sporting Goods, Inc., Q1 2025 Earnings Call, May 29, 2024).

Material Financial Impact (2024)

By 2024, GameChanger had clearly emerged as a material growth driver for DICK'S, achieving several important milestones:

Sources: (DICK'S Sporting Goods, Inc. Presents at Barclays 10th Annual Eat, Sleep, Play, Shop Conference, Dec-03-2024 01:30 PM, DICK'S Sporting Goods, Inc., Q3 2025 Earnings Call, Nov 26, 2024)

Inflection Point Analysis

The clear inflection point for GameChanger appears to occur in 2022-2023, evidenced by several factors:

Scale Achievement: The platform reached significant scale with nearly 6 million games covered annually and 280 million hours of user engagement (DICK'S Sporting Goods, Inc., Q4 2023 Earnings Call, Mar 07, 2023).

Financial Materiality: By 2024, GameChanger's revenue contribution became material enough to warrant inclusion in comparable sales calculations (DKS 10-Q Q3 2024).

Strategic Value Realization: The platform demonstrated clear synergies with DICK'S core business, as GameChanger users spent significantly more than typical customers (DICK'S Sporting Goods, Inc., Q1 2025 Earnings Call, May 29, 2024).

Profitability Profile: Management began consistently highlighting GameChanger's strong unit economics and profitability in investor communications (DICK'S Sporting Goods, Inc. Presents at Goldman Sachs 31st Annual Global Retailing Conference, Sep-05-2024 10:20 AM).

The platform's evolution from a baseball-focused scoring app to a comprehensive youth sports technology platform generating $100 million in revenue with 30-40% growth rates marks a clear transformation into a material growth driver for DICK'S Sporting Goods. The decision to include GameChanger revenue in comparable sales calculations starting in fiscal 2024 provides definitive evidence of its emergence as a meaningful contributor to overall company performance.

There have been plenty of other drivers of DKS’ recent success, but noteworthy that someone covering the name closely could have observed the inflection in 2023 well before the recent run-up in the stock.

To learn more about DKS, or find other companies nearing an inflection point in digital efforts, head over to Portrait!