Portrait Weekly Winners & Losers: INTC & ALAB

Welcome to this week’s edition of the Portrait Weekly Winners & Losers. This week, we’ll take a look at Intel (INTC) and Astera Labs (ALAB).

This week saw a dramatic reversal of fortunes as Intel surged on a transformative partnership with NVIDIA and potential Apple investment talks, while Astera Labs plummeted on fears that the same Intel-NVIDIA alliance could disrupt its connectivity solutions business.

Intel Corporation (INTC)

Intel’s stock experienced a powerful re-rating following the announcement of a landmark $5 billion investment from NVIDIA and reports of early-stage investment discussions with Apple.

What happened?

Using Portrait, we discover that Intel’s dramatic surge was initially driven by a multi-generational strategic collaboration with NVIDIA announced on September 18, 2025, fundamentally altering the market’s perception of the company’s turnaround prospects. Compounding this momentum, Bloomberg News reported on September 24 that Intel has approached Apple about securing a strategic investment and fostering a closer working relationship. While these talks remain in early stages, the news alone caused Intel’s shares to close higher as it aligned with the narrative of Intel successfully attracting premier technology companies as strategic partners.

A Landmark Partnership and Strategic Overtures Reshape Intel’s Narrative

The sharp upward move in Intel’s share price this week was driven by two distinct, yet thematically linked, announcements that fundamentally altered the market’s perception of the company’s competitive position and turnaround prospects.

The principal catalyst was the September 18 announcement of a multi-generational strategic collaboration with NVIDIA, the undisputed leader in AI and accelerated computing. This partnership is multifaceted, targeting both the data center and personal computing markets. For the data center, Intel will leverage its manufacturing and x86 expertise to design and build custom x86 CPUs for NVIDIA, which will be integrated into NVIDIA’s AI infrastructure platforms using its proprietary NVLink interconnect. For the PC market, Intel will develop and market x86 system-on-chips (SOCs) that integrate NVIDIA’s high-performance RTX GPU chiplets, a move poised to create a new class of high-performance PCs.

Critically, this collaboration was cemented by a $5 billion equity investment from NVIDIA into Intel common stock at a price of $23.28 per share. This investment serves as a powerful vote of confidence from the industry’s AI leader in Intel’s technology roadmap, manufacturing capabilities, and strategic direction under CEO Lip-Bu Tan. As NVIDIA CEO Jensen Huang stated, the collaboration represents a “fusion of two world-class platforms” that will “lay the foundation for the next era of computing.”

Compounding this positive momentum, a September 24 report from Bloomberg News revealed that Intel has approached Apple about securing a strategic investment and fostering a closer working relationship. While these talks are reportedly in early stages, the news alone caused Intel’s shares to close 9% higher, as it aligns with the narrative of Intel successfully attracting premier technology companies as strategic partners. For Apple, such a partnership would offer a path to diversify its chipmaking supply chain away from its heavy reliance on TSMC, a valuable hedge against geopolitical risk in Taiwan.

These events occurred against a backdrop of significant capital infusions that have bolstered investor sentiment over the past several months, including a deal for the U.S. government to take a ~10% stake in the company for approximately $10 billion and a separate $2 billion equity investment from SoftBank Group, which has pushed the stock up over 40% since mid-August.

What signs were there, in hindsight?

Looking back through Portrait’s analysis, we learn that the groundwork for this strategic transformation was laid over the preceding nine months under new CEO Lip-Bu Tan’s leadership.

Hindsight 20/20: Tracing the Path to Strategic Transformation

While this week’s announcements were transformative, a review of prior disclosures and strategic shifts reveals a clear trajectory toward these outcomes. The groundwork for this pivot was laid over the preceding nine months, signaling a company aggressively pursuing a new, partnership-centric strategy.

New Leadership and a New Mandate: The departure of CEO Pat Gelsinger on December 1, 2024, marked a critical inflection point. The board explicitly stated a need to “restore investor confidence” and appointed interim leadership with a mandate to act with urgency on simplifying the portfolio and advancing manufacturing capabilities. The subsequent appointment of Lip-Bu Tan as CEO on March 18, 2025, was the most significant signal. Mr. Tan, with his extensive background as CEO of Cadence Design Systems and founder of Walden International, brought a deep understanding of the fabless ecosystem and a proven track record of partnership-driven value creation. His public statements consistently emphasized rebuilding customer trust, seeking partners, and an “under promise and over deliver” motto.

Early Interest from NVIDIA: The collaboration with NVIDIA was not born in a vacuum. As early as March 2025, reports surfaced that NVIDIA and Broadcom were running manufacturing tests with Intel to evaluate its 18A process technology. NVIDIA CEO Jensen Huang also publicly confirmed that the company continuously evaluates Intel’s foundry technology, indicating an open dialogue long before the formal partnership was announced.

Aggressive Balance Sheet Fortification: Under the new leadership, Intel embarked on a concerted effort to strengthen its balance sheet and fund its ambitious capital expenditure plans. This included a series of major capital infusions and asset monetizations that made the company a more stable and attractive partner.

Government Backing: The U.S. government’s strategic interest in a resilient domestic supply chain culminated in an August 2025 agreement to convert prior CHIPS Act grant commitments into an $8.9 billion equity investment for a nearly 10% stake in the company. This move not only provided significant capital but also signaled strong government alignment with Intel’s success.

Strategic and Financial Investors: Intel secured a $2 billion equity investment from SoftBank in August 2025 and closed the sale of a 51% stake in its Altera business to Silver Lake in September 2025, which was expected to yield approximately $4.4 billion in net cash proceeds.

Foundry Imperative: Management has been transparent about the economic necessity of securing external customers to justify the immense cost of future process nodes. At a September 2025 conference, CFO Dave Zinsner reiterated that Intel would not commit capital for 14A capacity without firm customer commitments, creating a powerful incentive to strike large-scale partnerships.

Who else might be impacted, and what next?

Analyzing through Portrait, we discover that Intel’s strategic realignment will have significant ripple effects across the semiconductor landscape, creating new competitive pressures and opportunities.

Ecosystem Shockwaves and the Path Forward

The strategic realignment at Intel, crystallized by the NVIDIA partnership, will have significant second-order effects across the semiconductor landscape and sets a new, albeit challenging, path forward for the company.

Lateral Implications:

Competitors:

AMD: The Intel-NVIDIA collaboration poses a direct and formidable challenge to AMD. The plan to create integrated PC SoCs with Intel CPUs and NVIDIA RTX GPUs could disrupt AMD’s advantage in high-performance gaming laptops. In the data center, NVIDIA-customized Intel x86 CPUs could blunt the momentum of AMD’s EPYC processors, particularly in AI-adjacent workloads.

TSMC: The implications for TSMC are nuanced. While NVIDIA has stated its own GPU roadmap remains with TSMC, the potential for Apple to diversify its supply chain by leveraging Intel Foundry Services (IFS) represents a material long-term risk. A viable IFS introduces the first credible, at-scale, leading-edge foundry alternative in the Western hemisphere, which could impact TSMC’s pricing power and strategic positioning over time. However, Intel itself remains a key TSMC customer for certain products, such as the Lunar Lake processor.

ARM-based PC CPU Vendors (e.g., Qualcomm): The fusion of Intel’s x86 architecture with NVIDIA’s powerful RTX graphics in a single SoC strengthens the x86 ecosystem’s competitive standing, potentially slowing the encroachment of ARM-based designs into the Windows PC market, especially in performance-oriented segments.

Customers & Partners:

PC OEMs (Dell, HP, etc.): The new x86 RTX SOCs will enable a new tier of integrated-graphics laptops with performance capabilities previously reserved for discrete GPU models, opening up new design possibilities for gaming and content creation notebooks).

Hyperscalers (AWS, Microsoft, etc.): These customers gain another powerful compute option. The collaboration promises tightly integrated CPU-GPU platforms optimized for AI, complementing existing efforts like the custom Xeon and AI fabric chips Intel is developing for AWS on its Intel 3 and 18A nodes.

Apple: A potential partnership offers Apple a critical second source for leading-edge manufacturing, reducing its strategic dependence on TSMC and Taiwan. It would also align with Apple’s commitment to increase domestic investment, a politically astute move.

The bull case rests on turnaround validation through high-profile investments from NVIDIA, the U.S. government, and SoftBank, coupled with Intel’s position as the only at-scale leading-edge foundry alternative to Asian manufacturers. Bears counter that execution risk remains paramount given Intel’s history of product delays and manufacturing missteps, while the Intel Foundry Services business has yet to secure a major external customer for its leading-edge nodes. The path back to historical gross margins remains arduous as ramping new cost-intensive nodes creates significant start-up costs.

The Bull-Bear Debate: Turnaround Validation vs. Enduring Execution Hurdles

The recent developments have sharpened the bull and bear cases for Intel, shifting the primary debate from the company’s strategic viability to its ability to execute.

The Bull Case:

Turnaround Validated and De-Risked: The series of high-profile investments from NVIDIA, the U.S. government, and SoftBank, coupled with the deep technical collaboration with NVIDIA, serves as powerful third-party validation of Intel’s technology and manufacturing strategy. This significantly de-risks the balance sheet and quiets concerns about the company’s long-term viability.

Path to Manufacturing Leadership is Credible: The NVIDIA partnership, which relies on Intel’s manufacturing and advanced packaging, signals confidence in the company’s ability to execute on its process roadmap. The Intel 18A process remains on track for a H2’25 launch with Panther Lake, and the company is now positioned as the only at-scale leading-edge foundry alternative to Asian manufacturers, a position of immense strategic value.

Fortified Financial Position: Through strategic investments and asset sales like the Altera stake, Intel has amassed a significant capital base to fund its costly transition to new process nodes and navigate the turnaround without being financially constrained.

Strengthened x86 Moat: The collaboration to build integrated x86 SoCs with NVIDIA RTX GPUs creates a compelling new product category for high-performance PCs, reinforcing the dominance of the x86 ecosystem against challenges from ARM-based competitors.

The Bear Case:

Execution Risk Remains Paramount: Intel’s history is fraught with product delays and manufacturing missteps. The company’s “five nodes in four years” strategy is unprecedented in its ambition, and any slip could undermine partner confidence and financial targets. The delay of the Clearwater Forest server CPU due to advanced packaging issues serves as a recent cautionary tale.

Intel Foundry is Still Unproven: The NVIDIA deal is a win for Intel’s internal manufacturing, not a true external foundry customer win. IFS has yet to secure a major, public, high-volume commitment from an external customer for its leading-edge 18A or 14A nodes. Management has explicitly tied the future of the 14A node to securing such a customer, highlighting the risk.

Core Business Still Faces Headwinds: While the NVIDIA deal is a positive, Intel’s core Data Center and AI (DCAI) group continues to face intense competitive pressure from AMD. Management has acknowledged that upcoming server products like Diamond Rapids will help close the performance gap but may not fully reclaim leadership.

Margin Recovery is a Long Road: The path back to Intel’s historical gross margin profile is arduous. Ramping new, cost-intensive nodes like Intel 3 and 18A creates significant start-up costs, while the increasing use of external foundries for certain products (e.g., Lunar Lake on TSMC) is dilutive to margins. The trough may be behind them, but the slope of the recovery remains a key debate.

Astera Labs, Inc. (ALAB)

Astera Labs’ stock suffered a sharp decline following a Morgan Stanley report suggesting that the Intel-NVIDIA partnership could have “major implications” for the connectivity solutions provider.

What happened?

Using Portrait, we discover that Astera’s dramatic sell-off was directly precipitated by market concerns over undefined but potentially significant threats to its core business model. The Morgan Stanley report on September 19 suggested that Intel’s co-development deal with NVIDIA for PC and data center chips could have major implications for Astera Labs, though these implications remained frustratingly undefined.

The Catalyst: Unpacking the Intel-NVIDIA Partnership News

The significant sell-off in Astera Labs’ stock this week was directly precipitated by market concerns over a new competitive threat. On September 19, a Morgan Stanley report suggested that a newly announced deal for Intel to co-develop PC and data center chips with NVIDIA could have “major implications” for Astera Labs. The market’s reaction was severe, not because the implications were clearly negative, but precisely because they were, and remain, undefined. This uncertainty surrounding a potential shift in the data center competitive landscape was the core driver of the stock’s decline.

The market response included:

A daily stock decline of approximately 3% each day beginning on September 19 (Astera Labs’ stock tumbles nearly 11%).

A sharp tumble of nearly 11% on Wednesday, September 24, which represented the stock’s largest single-day intraday fall since April 4, 2025.

A potential market capitalization loss of approximately $4 billion.

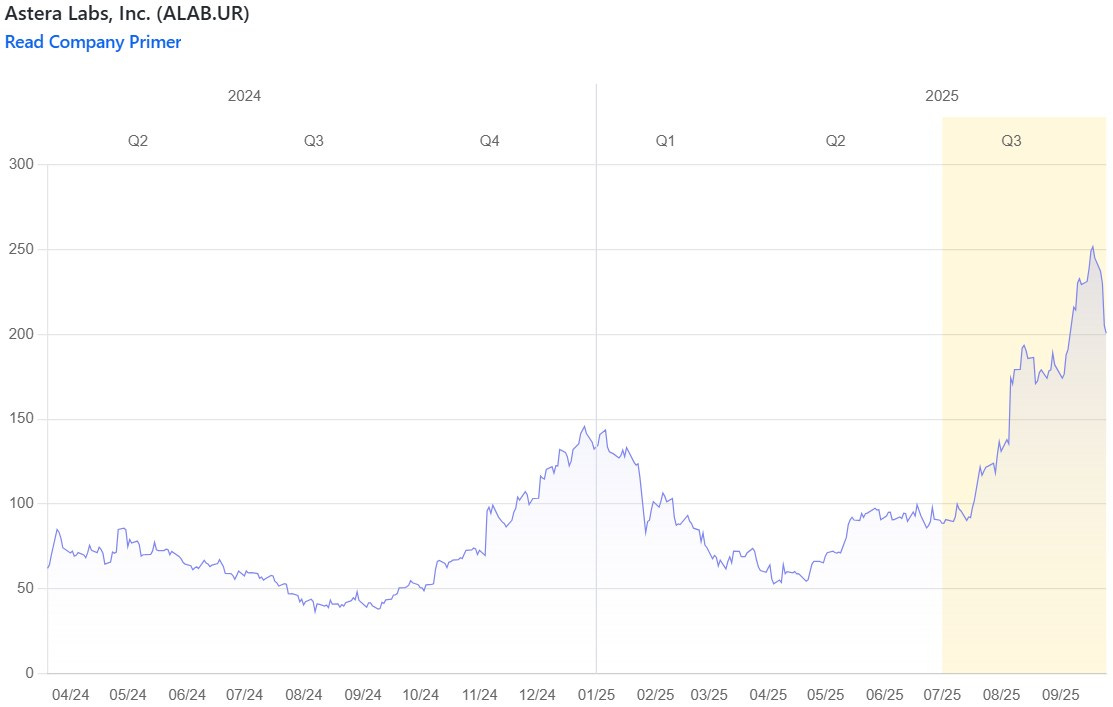

This reaction occurred against a backdrop of exceptionally strong performance, with the stock having surged approximately 178% in the prior six months and 300% over the past year, as of September 23. The introduction of a significant, unquantifiable risk to the company’s primary end market was sufficient to break this powerful momentum.

What signs were there, in hindsight?

Looking back through Portrait’s analysis, we learn that several pre-existing vulnerabilities made Astera particularly susceptible to negative reactions from ecosystem shifts.

Hindsight Analysis: Evaluating Pre-existing Vulnerabilities

In hindsight, several risk factors, repeatedly disclosed and discussed by the company, made Astera Labs particularly susceptible to a negative reaction from news of this nature.

Extreme Customer and Ecosystem Dependence: Astera’s business model is fundamentally dependent on the architectural choices of a very small number of hyperscale customers and the dominant AI platform providers. The company’s 2024 10-K explicitly notes that its top three end customers represented approximately 80% of revenue, and that the loss of, or a significant reduction in demand from, one of these customers would adversely affect its financial condition. A strategic alliance between Intel and NVIDIA, two of the most powerful players in the data center, has the potential to create a new, highly integrated platform architecture that could reduce the need for third-party connectivity solutions or favor a different set of suppliers, directly threatening Astera’s established design wins.

The “Offset” Strategy for NVIDIA Platforms: Management has previously addressed the fact that its retimer content on NVIDIA’s reference design for the Blackwell generation is lower than it was for the Hopper generation. The bull case rested on the strategy that this decline would be “much more than offset” by significant content gains from Astera’s Scorpio switch products in customized rack designs that hyperscalers build using NVIDIA’s technology. A deeper INTC-NVDA collaboration could lead to more complete and integrated reference platforms, reducing the scope for such customization and thereby threatening this critical offset dynamic.

Positioning in a Fragmenting Ecosystem: Astera has strategically positioned itself as the “Switzerland of connectivity,” aiming to sell into all major ecosystems: NVIDIA’s proprietary platforms, the emerging open-standard UALink ecosystem (backed by AMD, Google, Meta), and various custom ASIC programs. While this diversification is a strength, it also exposes the company to shifts in the balance of power. The INTC-NVDA deal could fortify the proprietary camp, creating a more formidable competitor to the open UALink standard that represents a cornerstone of Astera’s long-term growth strategy for its high-value Scorpio X-Series switches.

High Valuation and Stock Volatility: The stock’s meteoric rise of ~178% in the six months leading up to the event priced in a narrative of near-flawless execution and unabated growth. Such a valuation makes a stock highly sensitive to any negative news or increase in perceived risk. Historical trading patterns, such as the significant declines seen in April 2025, also demonstrated the stock’s inherent volatility.

Who else might be impacted, and what next?

Analyzing through Portrait, we discover that the Intel-NVIDIA partnership creates ripple effects across the AI ecosystem while clarifying Astera’s strategic challenges.

Lateral Implications and The Path Forward

The INTC-NVDA partnership news creates ripple effects across the AI ecosystem and clarifies the strategic path Astera must navigate.

Who Else Might Be Impacted?

Competitors (Broadcom, Marvell, Credo): These firms face the same fundamental risk of being designed out of a more closed INTC-NVDA ecosystem. However, the market may perceive relative winners and losers. If Astera is seen as having more concentrated exposure to the custom NVIDIA rack designs that are now in question, competitors could see an opportunity to gain share in other areas. The market often trades these names in sympathy, as seen when Credo (CRDO) moved on ALAB’s earnings news, indicating they are viewed as a cohort facing similar industry dynamics.

Hyperscale Customers (Google, Meta, Amazon): A key motivation for hyperscalers to back the UALink consortium, where Astera is a promoting member, is to foster an open, multi-vendor ecosystem and avoid lock-in to NVIDIA’s proprietary NVLink interconnect. A powerful INTC-NVDA alliance could be seen as a direct challenge to this goal. This may cause hyperscalers to either accelerate their UALink and custom silicon roadmaps to ensure a viable alternative, or be forced to align with the new dominant platform, altering the competitive landscape.

Ecosystem Partners (AMD): As a key promoter of UALink alongside the hyperscalers, AMD is positioned as a chief competitor to NVIDIA in the AI accelerator market. A strengthened INTC-NVDA front presents a more formidable competitive challenge to AMD and the entire open accelerator ecosystem that UALink is intended to support.

The bull case rests on Astera’s “Switzerland” positioning as a connectivity arms dealer agnostic to underlying processors, with strong traction in custom ASIC platforms offering higher dollar content independent of NVIDIA. The Scorpio fabric switch family addresses a $5 billion TAM by 2028 and is already ramping strongly, while the Intel-NVIDIA news may even accelerate the industry’s push toward the open UALink standard where Astera is a key enabler. Bears counter that a deeply integrated Intel-NVIDIA platform could create a proprietary walled garden minimizing third-party connectivity needs, while a powerful alliance could establish its own interconnect as the de facto standard, stunting UALink growth before mass adoption in 2027.

Key Debates: The Bull and Bear Cases from Here

The recent news has sharpened the primary debates surrounding Astera’s investment case.

The Bull Case Rests On:

Diversification and the “Switzerland” Thesis: Bulls argue that Astera is a connectivity arms dealer, agnostic to the underlying processor. The company’s traction with custom ASIC platforms, which offer higher dollar content by enabling Astera to play in both front-end and back-end networks, is a powerful growth driver independent of NVIDIA. An INTC-NVDA platform is simply another potential customer.

The Scorpio and UALink Growth Vector: The long-term story is increasingly about the Scorpio fabric switch family, not just Aries retimers. Scorpio is projected to address a $5 billion TAM by 2028 and is already ramping strongly with design wins for both scale-out (P-Series) and scale-up (X-Series) applications. The INTC-NVDA news may even accelerate the industry’s push toward the open UALink standard, where Astera is a key enabler.

Proven Execution: The company has a strong track record of financial outperformance, consistently beating revenue and EPS estimates and raising guidance throughout 2024 and 2025. Bulls will see the recent sell-off as an overreaction to an unconfirmed threat, creating a buying opportunity in a best-in-class operator.

The Bear Case Centers On:

Ecosystem Lock-Out Risk: The core bear thesis is that a deeply integrated INTC-NVDA platform could create a proprietary “walled garden” that minimizes or eliminates the need for third-party connectivity solutions. This is a direct threat to Astera’s business model and represents the materialization of the customer concentration risk that has always been present.

UALink Marginalization: A powerful INTC-NVDA alliance could establish its own interconnect as the de facto industry standard, stunting the growth of the UALink ecosystem before it achieves mass adoption in the 2027 timeframe. Astera has invested heavily and staked a significant part of its future growth on the success of UALink, making this a critical risk.

Broken Momentum and Valuation Risk: The stock’s premium valuation was supported by a narrative of unimpeded growth in a rapidly expanding market. The INTC-NVDA news introduces a major element of uncertainty and competitive risk, breaking the stock’s momentum and justifying a lower multiple. Until the “major implications” are clarified, the stock may remain under pressure as investors re-evaluate the company’s long-term growth trajectory and risk profile.

To dive further into INTC, ALAB, or any other public company, head over to Portrait!