Portrait Weekly Winners & Losers: ALAB & TTD

Welcome to this week's edition of the Portrait Weekly Winners & Losers. This week, we'll take a look at Astera Labs (ALAB) and The Trade Desk (TTD).

This week saw dramatic swings as Astera Labs surged on a spectacular earnings beat that validated its AI Infrastructure 2.0 thesis, while The Trade Desk plummeted despite beating estimates as guidance disappointment and a CFO departure spooked investors.

Astera Labs (ALAB)

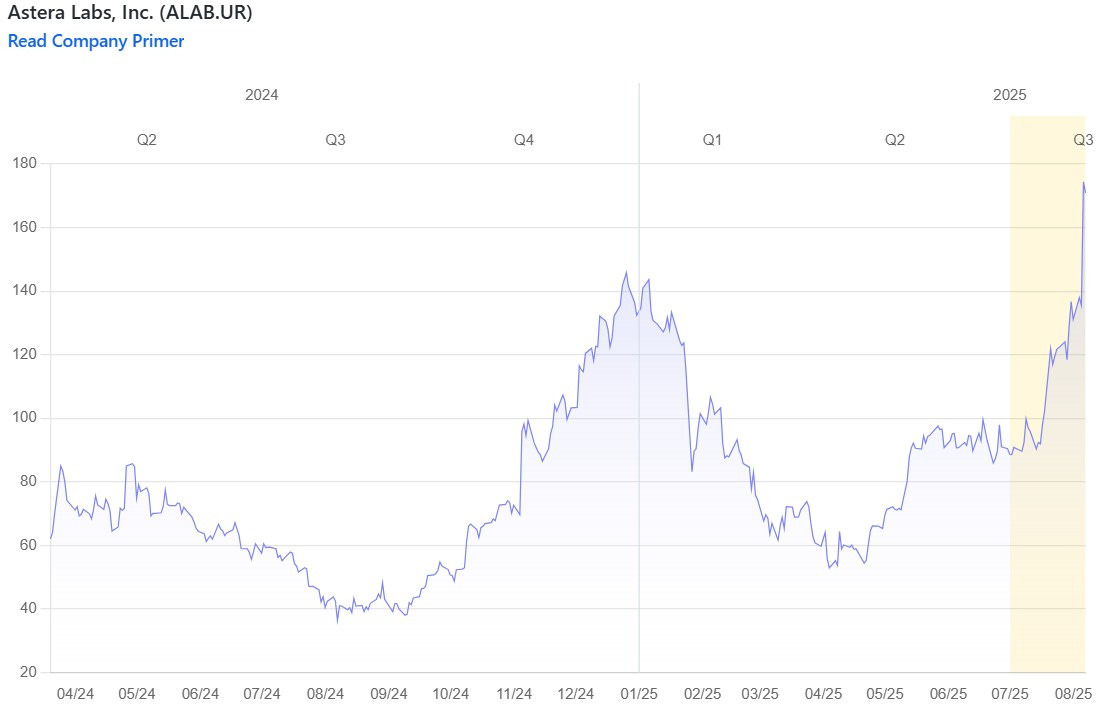

Astera Labs' stock soared to new 52-week highs following a decisive Q2 2025 earnings beat that demonstrated the successful transition from retimers to higher-value fabric switches and reinforced its strategic positioning in the evolving AI infrastructure landscape.

What happened?

Using Portrait, we discover that Astera's explosive performance was driven by a powerful combination of financial outperformance and strategic validation that exceeded even the most optimistic investor expectations.

Unpacking the Q2 Beat: Scorpio Ramp and AI 2.0 Thesis Drive Record Highs

The dramatic appreciation in Astera Labs' stock price during the week ending August 8, 2025, was a direct and powerful reaction to the company's second-quarter 2025 financial results and forward guidance, which significantly outstripped market expectations. The report, released after the market close on August 5, 2025, served as a major validation of the company's strategic pivot towards higher-value products and its central role in the evolving AI infrastructure landscape (News - August 2025 - ALAB.UR).

The core drivers can be summarized as follows:

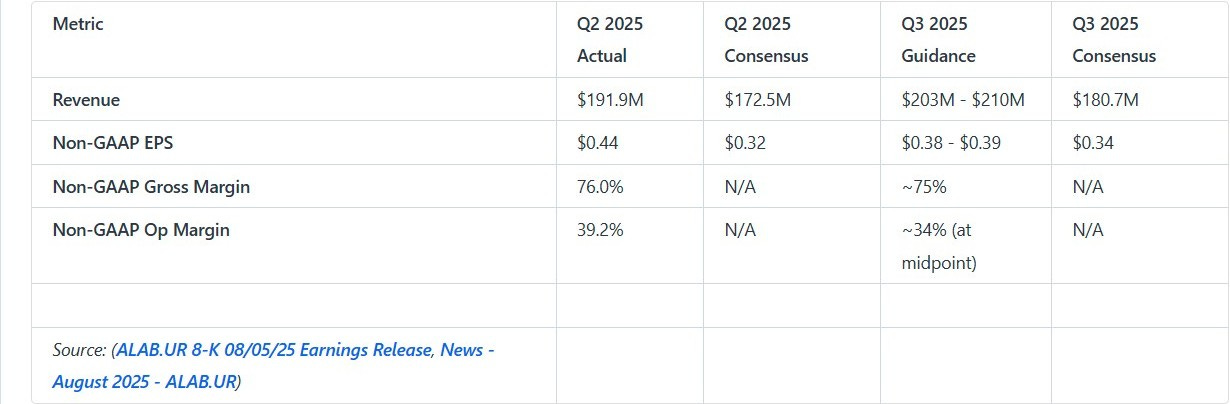

Decisive Financial Outperformance: Astera reported Q2 revenue of $191.9 million, a 20% sequential increase and well above the consensus estimate of $172.5 million. Non-GAAP diluted EPS came in at $0.44, beating the consensus of $0.32 by 37.5%. This top-line strength translated into significant operating leverage, with non-GAAP operating margin expanding to 39.2%, up from 33.7% in the prior quarter (ALAB.UR 8-K 08/05/25 Earnings Release, Astera Labs, Inc., Q1 2025 Earnings Call, May 06, 2025). The company's Q3 guidance for revenue of $203-$210 million and non-GAAP EPS of $0.38-$0.39 also pointed to sustained, above-consensus growth (ALAB.UR 8-K 08/05/25 Earnings Release).

Successful Scorpio Product Ramp: A key highlight of the quarter was the successful transition of the Scorpio smart fabric switches to volume production. Management revealed that Scorpio exceeded 10% of total revenue in Q2, making it the fastest-ramping product line in the company's history (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025). This was a critical proof point for investors, demonstrating Astera's ability to execute on its product roadmap and move up the value chain from retimers to more complex and higher-ASP fabric solutions. The ramp was driven by deployments of the Scorpio P-Series for PCIe 6 scale-out applications within customized rack-scale systems for leading GPUs (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025).

Validation of the "AI Infrastructure 2.0" Thesis: Management effectively used the earnings call to frame this success as the dawn of "AI Infrastructure 2.0," characterized by a shift toward open, standards-based, and interoperable rack-scale platforms (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025). Astera's leadership role in the UALink consortium, its expanded collaboration with NVIDIA on NVLink Fusion, and its partnership with ASIC leader Alchip Technologies were all presented as evidence of its strategic position as a critical, agnostic connectivity provider for this new era (ALAB.UR 8-K 08/05/25 Earnings Release). This narrative, backed by strong numbers, resonated with investors looking for durable, long-term growth drivers beyond a single customer or technology.

What signs were there, in hindsight?

Looking back through the past 6-12 months, we learn that Astera had been systematically building toward this inflection point through consistent execution and transparent communication about upcoming product cycles.

Hindsight is 20/20: Tracing the Path to the Breakout Quarter

While the magnitude of the Q2 2025 outperformance and subsequent stock reaction was striking, a review of prior disclosures reveals a clear and consistent pattern of execution and strategic positioning that foreshadowed this outcome. A sophisticated investor could have identified several key signals.

A Consistent Cadence of "Beat and Raise": Astera Labs had established a strong track record of exceeding expectations since its IPO.

In November 2024, the company reported Q3 2024 revenue of $113.1M vs. consensus of $97.5M and guided Q4 revenue to $126-130M, well above the $107.9M consensus (News - November 2024 - ALAB.UR).

In February 2025, it reported Q4 2024 revenue of $141.1M vs. consensus of $127.9M and guided Q1 revenue to $151-155M, again far ahead of the $133.8M consensus (News - February 2025 - ALAB.UR).

In May 2025, it reported Q1 2025 revenue of $159.4M vs. consensus of $153.1M and guided Q2 revenue to $170-175M, setting the stage for the eventual beat against the $172.5M consensus (News - May 2025 - ALAB.UR). This consistent outperformance demonstrated both strong underlying demand and conservative guidance, a classic setup for a positive earnings surprise.

Telegraphing the Scorpio Inflection: Management had been transparent about the timing and impact of the Scorpio product line for several quarters.

As early as the Q3 2024 earnings call (November 2024), the company guided that Scorpio would exceed 10% of revenues in 2025 and was already shipping in pre-production (Astera Labs, Inc., Q3 2024 Earnings Call, Nov 04, 2024).

In the Q4 2024 call (February 2025), management reiterated that Scorpio revenue would comprise "at least 10% of total revenue for 2025 with acceleration exiting the year" (Astera Labs, Inc., Q4 2024 Earnings Call, Feb 10, 2025).

In the Q1 2025 call (May 2025), they specified that Scorpio would shift from pre-production to volume production in the "late Q2 time frame" to support customized GPU-based AI systems (Astera Labs, Inc., Q1 2025 Earnings Call, May 06, 2025). The Q2 results confirmed this ramp occurred, and perhaps even faster than anticipated.

Publicly Cementing Leadership in Open Standards: Astera's strategic positioning in UALink was not a new development. The company announced it had joined the UALink Consortium as a promoting board member in November 2024 (ALAB 8-K 11/04/24 Earnings Release). It followed this by hosting a dedicated public webinar on UALink in May 2025, where it detailed the technology's benefits and outlined its vision to provide a comprehensive portfolio of solutions, signaling its deep commitment and leadership role in this critical emerging ecosystem (Astera Labs, Inc. Presents at Webinar on Ultra Accelerator Link™ Technology, May-20-2025 04:30 PM).

Increasingly Confident Management Tone: Throughout conference appearances in late 2024 and early 2025, management consistently expressed confidence. At a December 2024 conference, they noted that for the upcoming Blackwell generation, overall dollar content per system would increase significantly due to Scorpio, even as retimer content might decrease in certain form factors (Astera Labs, Inc. Presents at Barclays 22nd Annual Global Technology Conference 2024, Dec-11-2024 01:20 PM). By May 2025, they noted that the qualification process for Gen 6 products for the Blackwell platform was "progressing well" and that they expected to see "meaningful revenues from Scorpio P even earlier than anticipated" (Astera Labs, Inc. Presents at 53rd Annual JPMorgan Global Technology, Media and Communications Conference, May-14-2025 01:00 PM).

These data points, available prior to the Q2 earnings release, collectively painted a picture of a company with accelerating momentum, multiple growth drivers, and a clear strategic vision that the market was likely underappreciating.

Who else might be impacted, and what next?

Interestingly, Astera's success creates both competitive pressure and ecosystem opportunities while setting up critical execution milestones for the next phase of growth. The successful Scorpio ramp directly challenges Broadcom's dominance in the PCIe switch market, where it holds over 90% share. Astera's ground-up design for AI workloads, coupled with its COSMOS software, presents a differentiated alternative that could capture meaningful share as hyperscalers seek to dual-source critical components. In the active electrical cable market, Astera's growing Taurus business increases pressure on market leader Credo, while its continued retimer strength solidifies its lead against Marvell and Broadcom.

Ecosystem Ripples and the Path Forward

Astera's strong results and accelerating momentum have significant implications for its competitors, customers, and partners, while also clarifying the company's strategic path for the next 18-24 months.

Lateral Implications:

Competitors: The successful ramp of the Scorpio P-Series PCIe switch is a direct challenge to Broadcom (AVGO), which has long dominated the PCIe switch market with over 90% share (Astera Labs – Cloud Systems Architect at Microsoft Corp). Astera's ground-up design for AI workloads, coupled with its COSMOS software, presents a differentiated alternative that could capture meaningful share, particularly as hyperscalers seek to dual-source critical components (Astera Labs – Data Centre Connectivity & CXL Adoption Trend Outlook). In the active electrical cable (AEC) market, Astera's growing Taurus business increases pressure on Credo (CRDO), the market share leader (Astera Labs – Former Senior Executive, Technology at Astera Labs Inc). In the retimer space, Astera's continued strength and first-to-market position with Gen 6 solutions solidifies its lead against Marvell (MRVL) and Broadcom, who are seen as playing catch-up (Astera Labs – Former Senior Executive, Technology at Astera Labs Inc).

Customers & Partners: Astera's success strengthens the hand of hyperscalers like Amazon (AWS), Meta, and Microsoft by providing a viable, high-performance, open-standard alternative to proprietary interconnects. This supports their internal AI accelerator programs and efforts to build more customized, cost-effective AI racks (Astera Labs, Inc., Q3 2024 Earnings Call, Nov 04, 2024). The company's leadership in UALink is a significant tailwind for AMD and other accelerator vendors who are part of the consortium, as it provides a credible, open alternative to NVIDIA's NVLink for scale-up networking (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025). The relationship with NVIDIA remains nuanced; while Astera enables competing ecosystems, it is also a key partner, providing retimers and other connectivity for NVIDIA's merchant GPU platforms and recently expanding its collaboration to support the NVLink Fusion ecosystem (ALAB.UR 8-K 08/05/25 Earnings Release).

What's Next for Astera Labs:

The focus now shifts to a new set of execution milestones that will define the next phase of growth:

Ramp the Scorpio X-Series: While the P-Series drove the Q2 upside, the larger long-term opportunity is the Scorpio X-Series for scale-up GPU clustering. Management expects the X-Series to begin shipping in late 2025 and ramp to high-volume production through 2026, eventually outgrowing the P-Series (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025). This will be the key product cycle to monitor.

Commercialize UALink: Astera is a leading promoter of UALink and is developing a broad portfolio of solutions. The company expects the first UALink-based platforms to be qualified in the second half of 2026, with broader deployments in 2027 and beyond. This represents a multi-billion dollar long-term growth vector (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025, Astera Labs, Inc. Presents at Webinar on Ultra Accelerator Link™ Technology, May-20-2025 04:30 PM).

Execute on Next-Gen Product Cycles: Continued growth is expected from the Aries Gen 6 retimer cycle, the transition of Taurus AECs to 800-gig Ethernet in 2026, and the initial production ramp of Leo CXL memory controllers in the second half of 2025 as new CXL-capable CPUs from Intel and AMD become widely available (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025, Astera Labs, Inc., Q1 2025 Earnings Call, May 06, 2025).

Expand the "AI Infrastructure 2.0" Footprint: Astera will continue to push its vision of owning connectivity at the rack level, bundling its silicon, hardware modules, and COSMOS software into a holistic platform. The company has stated that scale-up connectivity alone will add nearly $5 billion to its market opportunity by 2030 (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025).

Looking ahead, the focus shifts to executing on the next wave of growth drivers. The larger opportunity lies with the Scorpio X-Series for scale-up GPU clustering, expected to begin shipping in late 2025 and ramp through 2026. Management expects the X-Series to eventually outgrow the P-Series, representing a multi-year growth engine. The commercialization of UALink, with first platforms qualified in the second half of 2026, represents a potential "multibillion-dollar incremental" opportunity by 2029.

Key Debates: The Bull and Bear Cases from Here

Following the significant re-rating of the stock, the key debates for investors have sharpened. Bulls will focus on the long-term, multi-faceted growth story, while bears will point to competitive threats, cyclical risks, and a demanding valuation.

The Bull Case:

Scorpio is a Multi-Year Growth Engine: The Q2 results were driven by the initial ramp of the Scorpio P-Series for scale-out connectivity. The larger opportunity lies with the Scorpio X-Series for scale-up, which addresses a market that is "effectively zero" today but is poised for explosive growth as hyperscalers build out their custom AI clusters (Astera Labs, Inc. Presents at 27th Annual Needham Growth Conference, Jan-15-2025 12:45 PM). Bulls see a multi-year runway as Astera penetrates this new, high-value market, with management expecting the X-Series to quickly outgrow the P-Series post-2026 ramp (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025).

UALink Unlocks a Massive TAM: Astera's role as a board member and key promoter of the UALink standard positions it at the center of the primary open-standard alternative to NVIDIA's proprietary NVLink. As the industry moves towards "AI Infrastructure 2.0," UALink is expected to become the standard for non-NVIDIA scale-up clusters. Management has quantified this as a potential "multibillion-dollar incremental" opportunity by 2029, on top of its existing TAM (Astera Labs, Inc. Presents at Webinar on Ultra Accelerator Link™ Technology, May-20-2025 04:30 PM).

Content Story is Powerful and Durable: The company is successfully expanding its dollar content per AI accelerator from sub-$100 for retimers to "multiple hundreds of dollars" with the addition of Scorpio switches and smart cable modules (Astera Labs, Inc., Q2 2025 Earnings Call, Aug 05, 2025). This content growth, combined with increasing attach rates in next-generation systems, provides a growth vector independent of underlying AI accelerator unit growth.

COSMOS Software Creates a Competitive Moat: The COSMOS software suite is a key differentiator, providing customers with a unified platform for diagnostics, fleet management, and customization across all Astera product lines. This integration makes the solutions "sticky" and difficult for competitors to displace, as it is deeply embedded in customers' data center management stacks (Astera Labs, Inc. Presents at Morgan Stanley Technology, Media & Telecom Conference, Mar-04-2025 04:05 PM, Astera Labs, Inc. Presents at 53rd Annual JPMorgan Global Technology, Media and Communications Conference, May-14-2025 01:00 PM).

The Bear Case:

Intensifying Competition from Incumbents: Astera is now competing head-to-head with formidable, well-capitalized incumbents. Broadcom is the established leader in PCIe switches and is unlikely to cede share without a fight; one former Astera executive noted hearing that Broadcom was offering retimers at "zero profit" to win business at Meta (Astera Labs – Former C-level Executive at Astera Labs Inc). Marvell and Credo are also established players in the retimer and AEC markets, respectively. Hyperscalers' desire for dual-sourcing could cap Astera's long-term market share (Astera Labs – Data Centre Connectivity & CXL Adoption Trend Outlook).

Long-Term Risk to Retimer Business: While currently a growth driver, the discrete retimer market faces long-term headwinds. As signal integrity improves with new process nodes and signaling technologies like PAM4, and as more functionality is integrated directly into switch ASICs and processors, the need for standalone retimers may diminish. One expert, a cloud systems architect at Microsoft, predicted that retimer volumes could begin to decline by 2027 (AI & Cloud Infrastructure Industry & Astera Labs – Cloud Systems Architect at Microsoft Corp). Astera itself has acknowledged that retimer content on certain Blackwell GPU configurations is lower than on the prior generation (Astera Labs, Inc. Presents at 27th Annual Needham Growth Conference, Jan-15-2025 12:45 PM).

Cyclical Risk and AI Spending "Digestion": The current pace of AI capital expenditures by hyperscalers may not be sustainable. A potential "digestion" period, a shift in investment priorities, or the emergence of more efficient AI models (as highlighted by the DeepSeek scare in January 2025) could lead to a slowdown in demand for AI hardware, to which Astera is highly exposed (News - January 2025 - ALAB.UR).

Demanding Valuation: Following a 31.7% single-day gain and a more than 300% rise over the past year, Astera's valuation is priced for flawless execution (News - August 2025 - ALAB.UR). Any delays in product ramps (Scorpio X, UALink), competitive stumbles, or a broader market downturn could lead to a significant stock price correction. The stock was downgraded on valuation concerns in July 2025, just prior to its earnings-driven surge (News - July 2025 - ALAB.UR).

The Trade Desk (TTD)

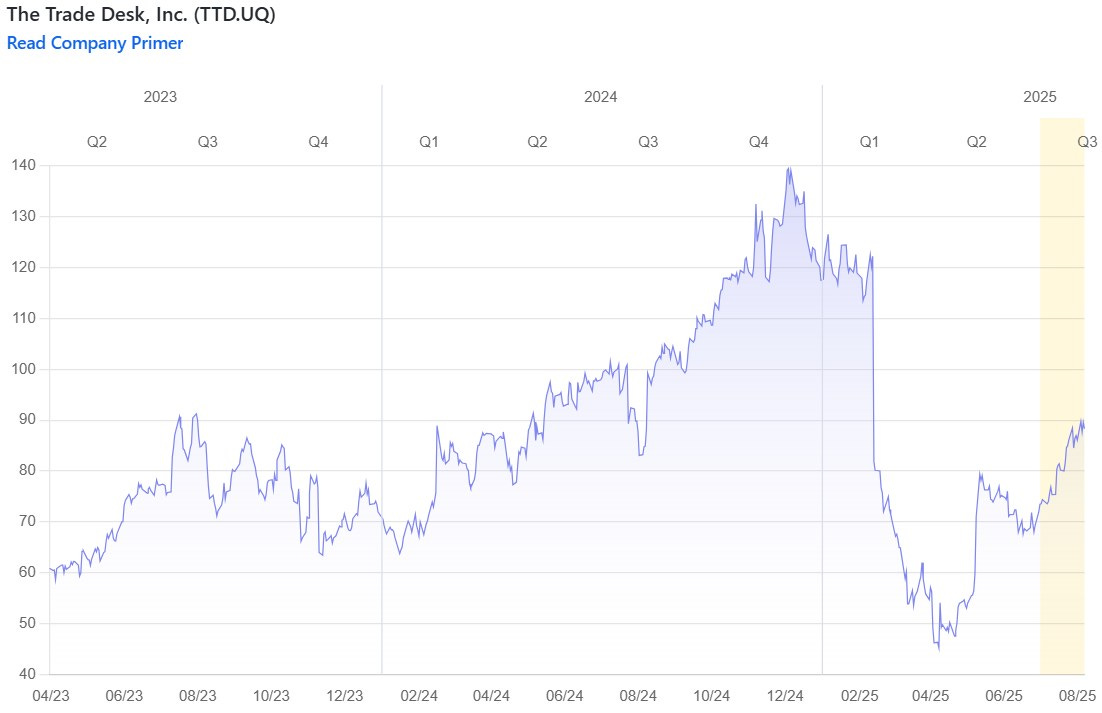

The Trade Desk's stock collapsed after reporting Q2 earnings despite beating estimates, as decelerating growth guidance, an unexpected CFO departure, and cautious macro commentary shattered confidence in the premium-valued growth story.

What happened?

Using Portrait, we discover that TTD's dramatic decline was triggered by a perfect storm of factors that undermined the core investment thesis despite solid quarterly results.

Unpacking the Q2 2025 Disappointment: Guidance, Leadership, and Macro Concerns

The dramatic negative reaction to The Trade Desk's Q2 2025 earnings report was not a response to the quarter's performance, which was strong, but rather to the outlook and accompanying announcements that collectively undermined confidence in the company's near-term growth trajectory. The stock fell approximately 28% in after-hours trading on August 7, a move precipitated by a trio of concerns that struck at the heart of the bull case for a premium-valued growth company (News - August 2025 - TTD.UQ, News - August 2025 - TTD.UQ).

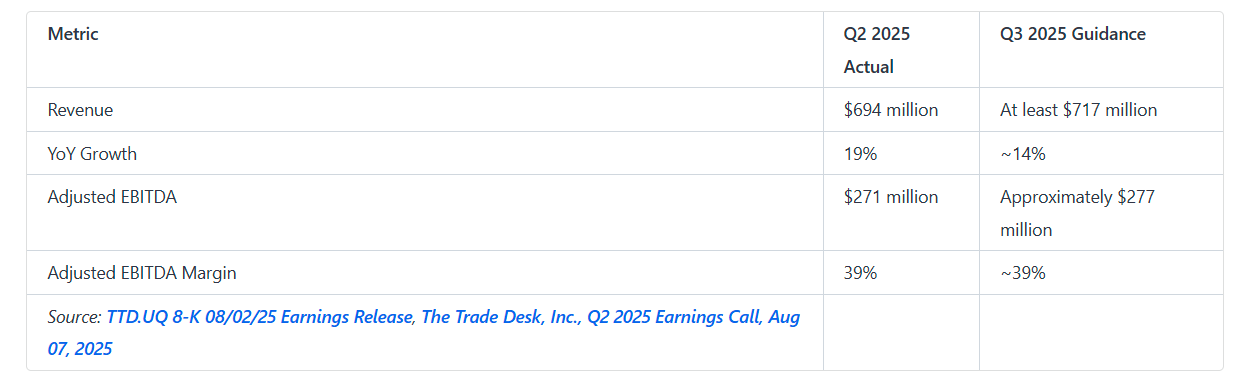

The primary catalyst was the company's financial guidance for the third quarter of 2025. While Q2 revenue of $694 million (+19% YoY) and Adjusted EBITDA of $271 million (39% margin) both exceeded consensus estimates, the Q3 forecast was less robust (TTD.UQ 8-K 08/02/25 Earnings Release, StreetAccount Sector Summary - Technology Post Market). Management guided for Q3 revenue of at least $717 million, implying a year-over-year growth rate of 14% (The Trade Desk, Inc., Q2 2025 Earnings Call, Aug 07, 2025). Even when adjusting for the impact of U.S. political ad spending in the prior-year comparable period, the estimated growth rate of approximately 18% represents a sequential deceleration from the roughly 20% growth (ex-political) achieved in Q2 (The Trade Desk, Inc., Q2 2025 Earnings Call, Aug 07, 2025). For a stock valued on the basis of sustained, high-speed growth, this deceleration was a significant red flag.

Compounding the guidance issue was the unexpected announcement of a change in the Chief Financial Officer role. The company disclosed that Laura Schenkein would transition out of the CFO position effective August 21, 2025, as part of a plan to depart by year-end (TTD.UQ 8-K 08/03/25 Departure of Directors or Certain Officers; Ele...). She will be succeeded by Alexander Kayyal, a member of the company's board of directors since February 2025 (TTD.UQ 8-K 08/03/25 Departure of Directors or Certain Officers; Ele...). While the company presented the transition smoothly, highlighting Mr. Kayyal's experience at Salesforce and as an early investor in TTD, the suddenness of the change created uncertainty around leadership stability and financial stewardship during a challenging period (The Trade Desk, Inc., Q1 2025 Earnings Call, May 08, 2025 (Presentation), News - August 2025 - TTD.UQ).

Finally, management's commentary on the earnings call amplified investor concerns about the macroeconomic environment. CEO Jeff Green spoke of "volatile environments" and noted that "some of the world's largest brands are absolutely facing pressure and some amount of uncertainty," specifically mentioning tariff uncertainty as a potential disruptor (The Trade Desk, Inc., Q2 2025 Earnings Call, Aug 07, 2025). This more cautious tone, combined with decelerating guidance and a leadership shuffle, created a perfect storm that led investors to question whether the company's growth narrative and premium valuation were sustainable in the current climate (News - August 2025 - TTD.UQ).

What signs were there, in hindsight?

Looking back through the preceding nine months, several warning signs emerged that hinted at TTD's increasing vulnerability to execution stumbles or sentiment shifts.

Hindsight is 20/25: Pre-existing Cracks in the Growth Narrative

In retrospect, several signs emerged over the preceding nine months that hinted at The Trade Desk's increasing vulnerability to an execution stumble or a shift in market sentiment. The most significant precursor was the company's Q4 2024 earnings report in February 2025, which marked the first time in 33 quarters as a public company (excluding a COVID-related revision) that TTD fell short of its own expectations (The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025). The company missed revenue and EBITDA consensus and provided a Q1 guide that was also below Street estimates, particularly on profitability (News - February 2025 - TTD.UQ). Management attributed the miss to internal factors, including "a series of small execution missteps," a major company reorganization in December 2024, and a slower-than-anticipated rollout of its new Kokai platform (The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025). The market reaction was severe, with the stock falling over 27% in post-market trading, establishing a precedent for how investors would treat any signs of faltering growth (News - February 2025 - TTD.UQ).

Following this event, analyst channel checks throughout the spring of 2025 provided further cautionary data points. In April, Stifel's checks with ad agencies revealed that near-term trends for TTD sounded "slightly weaker," with particular softness in the automotive vertical, and that agency perceptions of the new Kokai platform were "very mixed" (News - April 2025 - TTD.UQ). KeyBanc's checks in the same month were described as "deteriorating," citing spending uncertainty among auto, CPG, and retail verticals, leading the firm to predict a "softer Q2 guide" for TTD (News - April 2025 - TTD.UQ).

Concerns around competition, particularly from Amazon, also intensified. In June 2025, an AdWeek report circulated detailing a shift in ad spend from TTD to Amazon's DSP, with sources citing Amazon's lower fees and better user interface as key drivers. The report specifically mentioned a global auto brand shifting an estimated $80 million in annual spend away from TTD by the end of Q1 (News - June 2025 - TTD.UQ).

Even TTD's own commentary prior to the Q2 release contained hints of moderation. While the Q1 2025 results in May were strong, management acknowledged a "volatile macro backdrop" and its potential impact on large global brands (The Trade Desk, Inc., Q1 2025 Earnings Call, May 08, 2025). The Q2 revenue guidance provided at that time, for 17% year-over-year growth, already represented a material deceleration from the 25% growth delivered in Q1, signaling that the pace of expansion was moderating (TTD 8-K 05/08/25 Earnings Release). These factors—prior execution issues, weakening ad checks, rising competition, and management's own cautious undertones—collectively painted a picture of a company facing more significant headwinds than its premium valuation implied.

Who else might be impacted, and what next?

Analyzing TTD's situation, we learn that the challenges create uncertainty across the digital advertising ecosystem while forcing strategic pivots for the company itself.

Ecosystem Ripple Effects and The Path Forward

The challenges highlighted in The Trade Desk's Q2 report and outlook have broader implications for the digital advertising ecosystem and set a demanding path forward for the company itself. The commentary on a cautious spending environment and increased complexity suggests that other demand-side platforms, including Google's DV360 and independent players, may face similar macro pressures (The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025 (Presentation)). However, the situation may also benefit certain competitors; reports of brands shifting spend to Amazon's DSP on the basis of lower fees and a better user interface indicate that Amazon could be a direct beneficiary of any client dissatisfaction or budget scrutiny at TTD (News - June 2025 - TTD.UQ).

Supply-side platforms (SSPs) such as Magnite and PubMatic, which rely on demand from DSPs like TTD, may experience negative second-order effects. As TTD becomes more selective about its supply partnerships and focuses on optimizing quality and pricing, SSPs could face reduced fill rates and margin compression (The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025 (Presentation)). This dynamic is exacerbated by TTD's own strategic initiatives like OpenPath, which creates direct connections to publishers, bypassing traditional SSP intermediaries (Adtech Industry – The Trade Desk, Google, Magnite & Viant Technology – Former Senior Executive, Business Development Enterprise at Viant Technology Inc).

For The Trade Desk, the path forward requires flawless execution on multiple fronts to regain investor trust.

Leadership & Execution: The immediate priority is to ensure a seamless CFO transition and successfully integrate new COO Vivek Kundra, who joined in March 2025 (TTD 8-K 05/08/25 Earnings Release). Operationally, the company must complete the migration of all clients to the Kokai platform by year-end, a process that is reportedly ahead of schedule with three-quarters of spend already transitioned (The Trade Desk, Inc., Q2 2025 Earnings Call, Aug 07, 2025). Demonstrating tangible performance improvements from Kokai, as well as from the newly acquired Sincera data assets, will be critical.

Strategic Focus: The company must navigate the uncertain macro environment, which may require a "more measured approach to near-term investments" (The Trade Desk, Inc., Q2 2024 Earnings Call, Aug 08, 2024 (Presentation)). This includes carefully managing its international expansion, which has been a consistent growth driver but also a source of execution challenges (The Trade Desk, Inc., Q1 2025 Earnings Call, May 08, 2025, The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025 (Presentation)).

Corporate Governance: Management will also need to address investor sentiment regarding its proposal to extend the company's dual-class share structure, which CEO Jeff Green argues is essential for maintaining a long-term strategic orientation against short-term pressures (The Trade Desk, Inc., Q2 2025 Earnings Call, Aug 07, 2025).

The central debate now centers on whether TTD's challenges represent temporary cyclical headwinds or structural erosion of its competitive position. Bulls argue the issues are temporary, pointing to the company's independent, buy-side-only model, superior technology, and robust data marketplace as durable competitive moats. They emphasize consistently high customer retention over 95% and ongoing secular shifts to CTV and retail media as powerful long-term tailwinds that will allow resumed acceleration once macro uncertainty abates.

The Central Debates: Cyclical Stumble or Structural Shift?

The sharp re-rating of The Trade Desk's stock has crystallized the key debates that will define its investment narrative going forward. These discussions center on whether the current issues are temporary or permanent, and if the company's competitive advantages remain intact.

Temporary Headwinds vs. Structural Erosion: The primary debate is whether TTD's decelerating growth is a cyclical function of a volatile macro environment and fixable internal missteps, or the beginning of a structural trend of market maturation and commoditization.

Bull Case: Bulls argue that the challenges are temporary. They maintain that TTD's independent, buy-side-only model, superior technology, and robust data marketplace provide a durable competitive moat (The Trade Desk – Agency Customer Angle – Long-term Strategy for Programmatic Domination). They point to consistently high customer retention of over 95% and the ongoing secular shifts to CTV and retail media as powerful, long-term tailwinds that will allow the company to resume accelerated growth once macro uncertainty abates and internal execution is solidified (TTD.UQ 8-K 08/02/25 Earnings Release, The Trade Desk, Inc., Q1 2025 Earnings Call, May 08, 2025 (Presentation)).

Bear Case: Bears contend that the programmatic market is becoming more competitive and TTD's moat is narrowing. They point to evidence of pricing pressure and client defections to platforms like Amazon's DSP as proof that TTD's premium positioning is under threat (News - June 2025 - TTD.UQ, The Trade Desk, Inc., Q3 2024 Earnings Call, Nov 07, 2024 (Presentation)). The CFO departure adds to concerns about execution and governance, and the decelerating growth profile no longer justifies the stock's historical premium valuation (The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025 (Presentation)).

Leadership in High-Growth Channels: A secondary debate focuses on TTD's ability to dominate the next waves of programmatic growth in CTV and retail media.

Bull Case: TTD has an early-mover advantage in CTV and has established deep partnerships with major players like Netflix, Disney, Roku, and Fox (The Trade Desk, Inc., Q3 2024 Earnings Call, Nov 07, 2024, The Trade Desk, Inc., Q2 2024 Earnings Call, Aug 08, 2024). Its platform's ability to orchestrate complex, omnichannel campaigns is seen as unparalleled (The Trade Desk – Agency Customer Angle – Long-term Strategy for Programmatic Domination). The growth of live sports on streaming is viewed as a massive opportunity that TTD is well-positioned to capture (The Trade Desk – Customer Angle – Drivers of Its Dominant DSP Position).

Bear Case: Competition in these channels is intensifying rapidly from giants like Google (YouTube) and Amazon (Prime Video, retail media). Amazon's objectivity problem is a frequent TTD talking point, but its integration of retail data and massive consumer footprint is a formidable advantage (The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025). Furthermore, some view TTD's investment in its own TV operating system, Ventura, as a misguided effort in a market already dominated by Roku and Amazon (The Trade Desk – Customer Angle – Drivers of Its Dominant DSP Position).

Valuation and Investor Confidence: Ultimately, the debate comes down to valuation. Bulls believe the sell-off presents a buying opportunity for a best-in-class asset with a long runway for growth in a trillion-dollar TAM (The Trade Desk, Inc., Q4 2024 Earnings Call, Feb 12, 2025). Bears argue that the combination of decelerating growth, margin pressure, and execution risk means the stock must undergo a fundamental re-rating to a lower multiple that more accurately reflects its new reality (News - August 2025 - TTD.UQ).

To dive further into ALAB, TTD, or any other public company, head over to Portrait!