The Financial Times recently published an article illustrating how outdoor shopping centers are booming, despite consistent fear of an e-commerce-driven apocalypse. Specifically, the FT highlights two developments for outdoor retail: growing occupancies and rising rents – especially when compared to closed / indoor malls.

With the data clearly showing a trend toward open-air shopping centers, we can use Portrait to analyze publicly traded REITs to understand which companies are capitalizing on this trend and may be well-positioned for the future, as consumers seem to spend time and money patronizing local strip malls. According to the FT's analysis, outdoor shopping centers have seen consistently higher occupancy rates and stronger rent growth compared to indoor malls over the past several years.

Let’s start by using Portrait’s Review Documents tool to sort all companies by exposure to outdoor / open-air shopping centers:

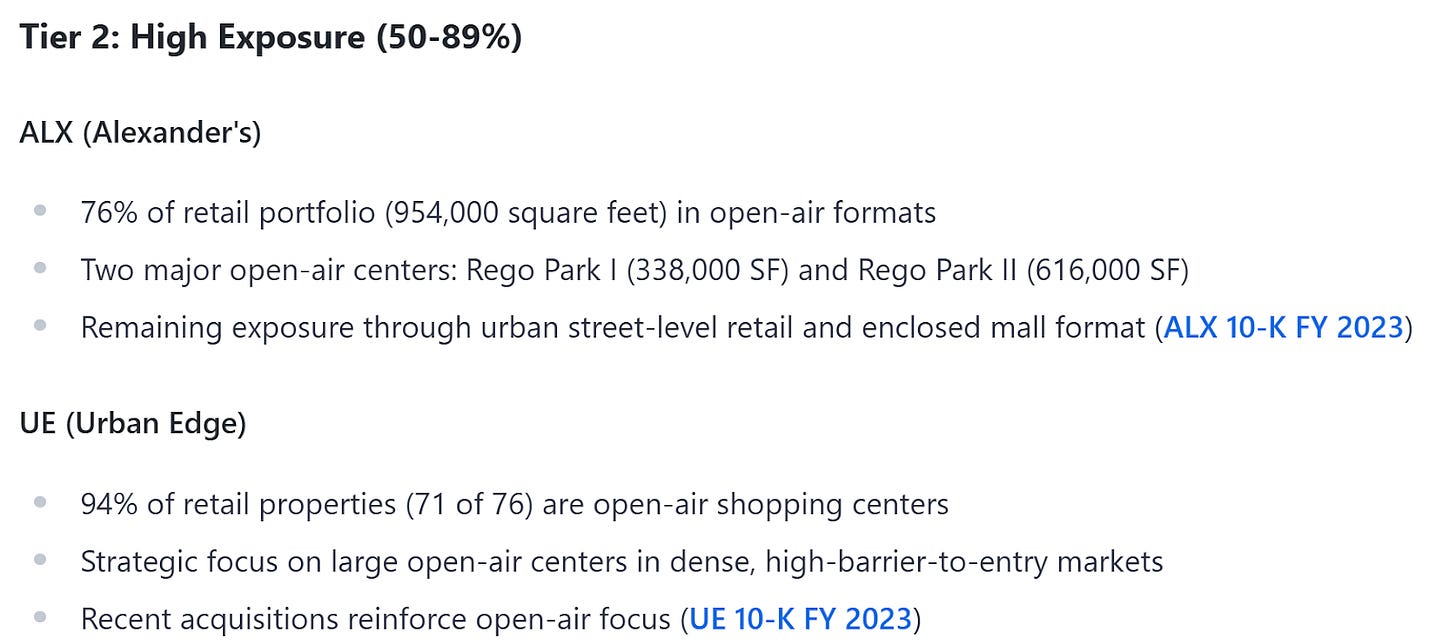

From here, we now have a good sense of which REITs are focused on open-air opportunities, with a delineation between more “pure-play” companies and those with high exposure. Let’s target the pure-play category. From here, I asked Portrait to create a table comparing key KPIs for these REITs:

Flipping through the table and key debates summaries, BRX strikes me as interesting, particularly given its strong metrics and callout of supply-demand imbalances in open-air retail, which aligns with our earlier read from the FT article. Further, a key bear argument rests on e-commerce competition, which earlier trends we highlighted seem not to be hurting its core offering.

To dig into BRX, head over to Portrait today!